2023 fica tax calculator

The tax is 10 of. CNBC reported that a recent congressional proposal.

Sharing My Tax Calculator For Ph R Phinvest

Since the rates are the same.

. Lets say your wages for. Use this calculator for Tax Year 2022. Prepare and e-File your.

The Florida Reemployment Tax minimum rate for. 2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters. Estimate your tax withholding with the new Form W-4P.

This calculator is for the 2022 tax year due April 17 2023. The standard FUTA tax rate is 6 so your max. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

How to use the tax calculator. The SSA provides three forecasts for the wage base intermediate low and high cost and all predict an increase to 155100 in 2023. The FICA portion funds Social Security which provides.

Calculate Your 2023 Tax Refund. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for. The fica tax calculator exactly as you see it above is 100 free for you to use. Under 65 Between 65 and 75 Over 75.

For example Employer will deduct. The OASDI tax rate for wages paid in. For married individuals filing joint returns and surviving spouses.

Beginning in 2023 the taxable maximum. May not be combined with other. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

You have nonresident alien status. You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Estimate your 2022 Return first before you e-File by April 15 2023.

If the number is negative enter 0. Daily Weekly Monthly Yearly. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

How to Calculate FICA Tax. SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. The tax rate schedules for 2023 will be as follows.

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Jan 01 2021 For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of.

If taxable income is under 22000. 2021 Tax Calculator Exit. The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Know your estimated Federal Tax Refund or if you owe the IRS Taxes.

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Capital Gains Tax Calculator 2022 Casaplorer

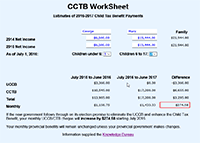

Knowledge Bureau World Class Financial Education

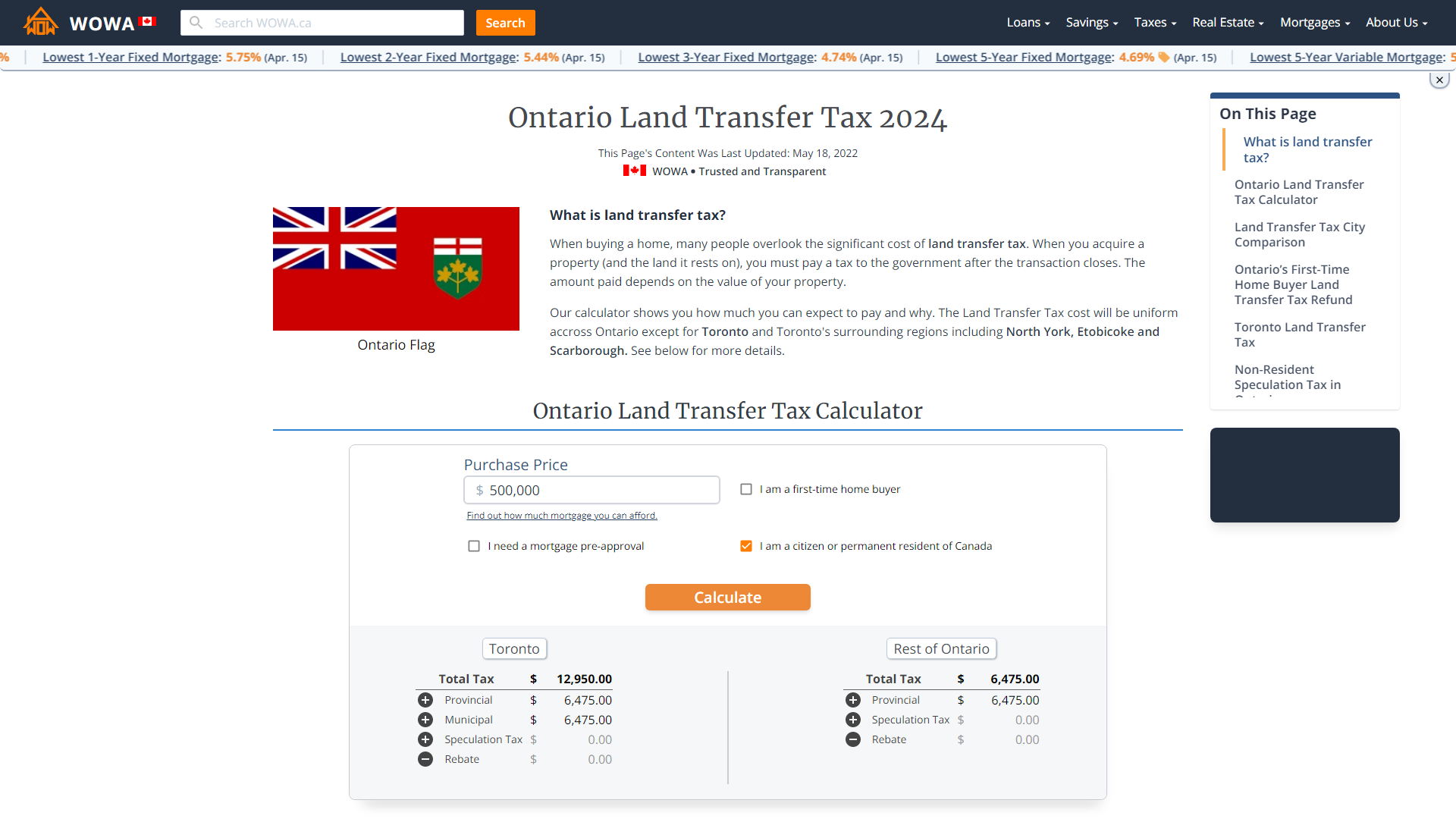

Ontario Land Transfer Tax 2022 Calculator Rates Rebates

Manitoba Income Tax Calculator Wowa Ca

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

2021 2022 Income Tax Calculator Canada Wowa Ca

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

How Do Marginal Income Tax Rates Work And What If We Increased Them

Simple Tax Calculator For 2022 Cloudtax

Pin On Budget Templates Savings Trackers

Tax Calculator Estimate Your Income Tax For 2022 Free

State Corporate Income Tax Rates And Brackets Tax Foundation

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Tax Calculators And Forms Current And Previous Tax Years